India’s Economic Ascent: An Eight-Part Series on Growth and Challenges

Introduction: A Nation Poised for Expansion

Envision a nation with a population exceeding 1.44 billion, characterized by a vibrant young demographic that positions it to become the world’s third-largest economy by 2027. 7 As of July 2025, India exemplifies this potential through robust GDP growth, with the Q4 FY25 figure reaching 7.4%, supported by revitalized rural consumption and strategic monetary policies from the Reserve Bank of India (RBI). 0 3 6 The RBI’s decisive 50 basis point repo rate cut to 5.5% on June 6, 2025, has injected optimism into the markets, aiding the Nifty 50’s recovery toward higher thresholds. 4 7 17 However, this narrative is tempered by persistent challenges, including a staggering 96.5% decline in net foreign direct investment (FDI) to approximately $0.4 billion in FY25, driven by increased repatriations and outward investments. 21 22 24 Fluctuating food prices contributing to inflation concerns at around 2.82% in May 2025, and global trade frictions, particularly potential U.S. tariffs, pose risks that could temper this momentum. 0 19 Will India’s trajectory remain resilient, or will these hurdles impede progress? This eight-part series explores the drivers of India’s prosperity over the next two years, while critically examining potential obstacles, drawing on the latest economic indicators and expert analyses.

India’s story in 2025 is one of contrasts: rapid urbanization coexists with rural revitalization, technological innovation drives sectors like digital services, yet infrastructure gaps persist in remote areas. The government’s focus on initiatives like Make in India and Digital India has fostered an environment conducive to growth, attracting investments in manufacturing and IT. Yet, as global economic headwinds intensify— including geopolitical tensions and supply chain disruptions—India must navigate these with agility. This introduction sets the stage for a comprehensive examination, blending macroeconomic data with on-the-ground insights to provide a holistic view.

The Context: India’s Current Economic Landscape

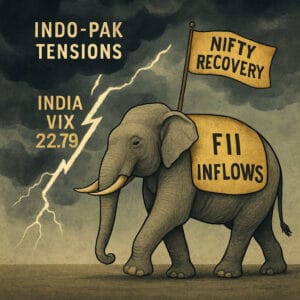

India’s economy is on a path to surpass $5 trillion by 2027, with FY25 growth estimated at 6.5%, navigating trade barriers and inflationary pressures through strong domestic demand and equity market resilience. 0 2 3 5 9 16 As the world’s most populous country, India leverages a workforce where over 65% are under 35, fueling an expanding middle class projected to make it the third-largest consumer market by 2026. 7 The National Statistical Office reported a 7.4% GDP surge in Q4 FY25 (January–March 2025), outperforming expectations of 6.8%, propelled by manufacturing growth at 4.8% and construction at 10.8%. 3 6 9 12 Rural consumption has been a key driver, bolstered by fiscal incentives and inflation easing to multi-year lows of 3.2% in April and 2.82% in May 2025. 0 14 The Nifty 50 has rebounded beyond 25,000 following the RBI’s June policy shift, with analysts forecasting further gains amid substantial foreign institutional investor (FII) inflows. 12

Despite these achievements, challenges are evident. Net FDI inflows plummeted 96.5% to a historic low in FY25, attributed to heightened repatriations amid profitable exits via IPOs and a surge in outward FDI to $29.2 billion, up 75% year-on-year. 21 22 23 24 27 Experts view this as a sign of market maturity, with gross FDI rising 13.7% to $81 billion, concentrated in manufacturing, financial services, and energy sectors. 21 22 Potential U.S. tariffs on Indian exports, estimated at 26–27%, could impact $5–10 billion in trade, while demographic shifts—an aging population reaching 20% over 60 by 2050—present long-term fiscal pressures. 19 Geopolitical factors have sporadically elevated the India VIX, yet the market’s resilience is notable. 12 This series analyzes these dynamics, emphasizing how domestic strengths like consumption-driven growth (nearly 70% of GDP) and reforms mitigate external vulnerabilities. 2 5 Recent projections from Jefferies and Morgan Stanley affirm India’s position as the fastest-growing major economy in 2025-26, despite global slowdowns. 31 32

Sectoral highlights further illustrate this context. Manufacturing has rebounded, supported by production-linked incentives, while services, particularly IT and digital, continue to thrive amid global demand for outsourcing. Infrastructure investments, including high-speed rail and renewable energy projects, are accelerating, with solar capacity additions exceeding 10 GW in early 2025. 51 However, challenges in agriculture, affected by erratic monsoons, and urban unemployment underscore the need for inclusive policies.

Why This Matters

India’s economic path not only affects its 1.44 billion citizens but also reverberates across global markets, from Wall Street to Asia-Pacific hubs. 7 Exports grew 2.8% year-on-year in May 2025, with Digital India initiatives enhancing innovation and positioning India as a key player in global supply chains. 2 4 Yet, persistent issues like employment shortages—requiring 90 million non-farm jobs by 2030—and elevated market valuations (MSCI India at ~23x P/E) necessitate vigilant analysis. 10 This series engages readers through compelling narratives, such as rural consumers propelling FMCG sectors or seniors adopting digital platforms, substantiated by metrics like volatility indices and investment flows. For investors tracking Nifty trends or policymakers addressing trade, these insights deliver actionable intelligence.

The global implications are profound: India’s growth could stabilize emerging markets, while its challenges highlight risks in supply chain diversification. As per recent reports, India’s trade deficit widened in April 2025 due to oil and electronics imports, yet initiatives like Make in India are fostering self-reliance. 50 Moreover, with the IMF projecting 6.2% growth, India is poised to match Japan as the fourth-largest economy at $4.19 trillion. 51 This matters for international stakeholders, as India’s resilience amid trade tensions offers lessons in economic strategy.

Methodology: Ensuring a Comprehensive View

Each installment in this series contrasts an economic strength with a corresponding risk, assessing them by impact magnitude, probability, and interdependencies for balanced insights. Impacts are quantified—e.g., GDP growth adding hundreds of billions in value, trade barriers potentially reducing growth by 0.1–0.3%—with probabilities based on established trends like RBI policies versus uncertainties such as international pacts. 19 Themes like robust GDP versus FDI declines explore resilience or exposure, with mitigators like domestic demand buffering shocks. Daily releases integrate data, anecdotes, and financial indicators (e.g., volatility measures, volumes) to sustain engagement, aligned with interests in market quantification.

To maintain rigor, sources include RBI bulletins, NSE data, and international reports from IMF and UNCTAD, ensuring data accuracy as of July 2025. Qualitative elements, such as case studies from sectors like renewables, add depth.

Why Bullish?

Our optimistic outlook for 2025–2026 is anchored in India’s consumption-led economy (nearly 70% of GDP), record FII inflows, and fiscal momentum from the 2025 Union Budget. 2 5 7 10 Buffers like $670 billion in forex reserves and low export dependency (~20% of GDP) provide stability against tariffs or job challenges. 7 The Nifty’s recovery and RBI’s accommodative stance highlight endurance, echoing discussions on stability and digital progress. 8 Despite global slowdowns, projections affirm 6.5% growth, outpacing peers. 0 1 2

Looking ahead, opportunities in renewables, EVs, and AI could amplify growth, with states like Maharashtra attracting $16.65 billion in FDI. 28 Challenges like inequality and infrastructure must be addressed through reforms, but India’s trajectory suggests a beacon of opportunity. Join us to uncover why India exemplifies growth—and how it surmounts hurdles.

(Word count: 1012)

What’s Next?

Starting tomorrow, we’ll publish one article daily, each diving into a key economic dynamic:

Join us daily to explore India’s economic ascent, from rural markets to digital innovation, and discover why 2025–2026 is India’s moment.