RBI’s Bold Stimulus Amid Lingering Caution

“Bulati hai magar jaana nahi“

Pankaj Tripathi’s line in Stree nails the Indian investor’s dilemma—lured by the Nifty 50’s potential but gripped by fear

-Stree

Introduction

The Reserve Bank of India (RBI) delivered a substantial 50 basis point (bps) repo rate cut to 5.5% alongside a 100 bps Cash Reserve Ratio (CRR) reduction on June 6, 2025, to invigorate economic expansion amid encouraging consumption signals.timesofindia.indiatimes.com+2 more This aligns with rural FMCG volumes rising 8.4% in Q1 2025 and passenger vehicle sales edging up 0.8% in May 2025, per SIAM figures.in.investing.com+2 more Yet, the Nifty, rebounding from a 10.3% decline, ended at about 25,149.85 on July 10, 2025, facing resistance at 25,100–25,350 due to U.S. tariff risks, Brent crude near $70 per barrel, and May 2025 domestic inflation at 2.82%.business-standard.com+2 more This report examines the balance between RBI’s initiatives and market reservations, projecting Q2 FY26 (July–September 2025) earnings across Financials, IT, Energy, Consumer Goods, and Automobiles, highlighting risks, prospects, transformative potentials, and expected trajectories.

Opportunities and Challenges

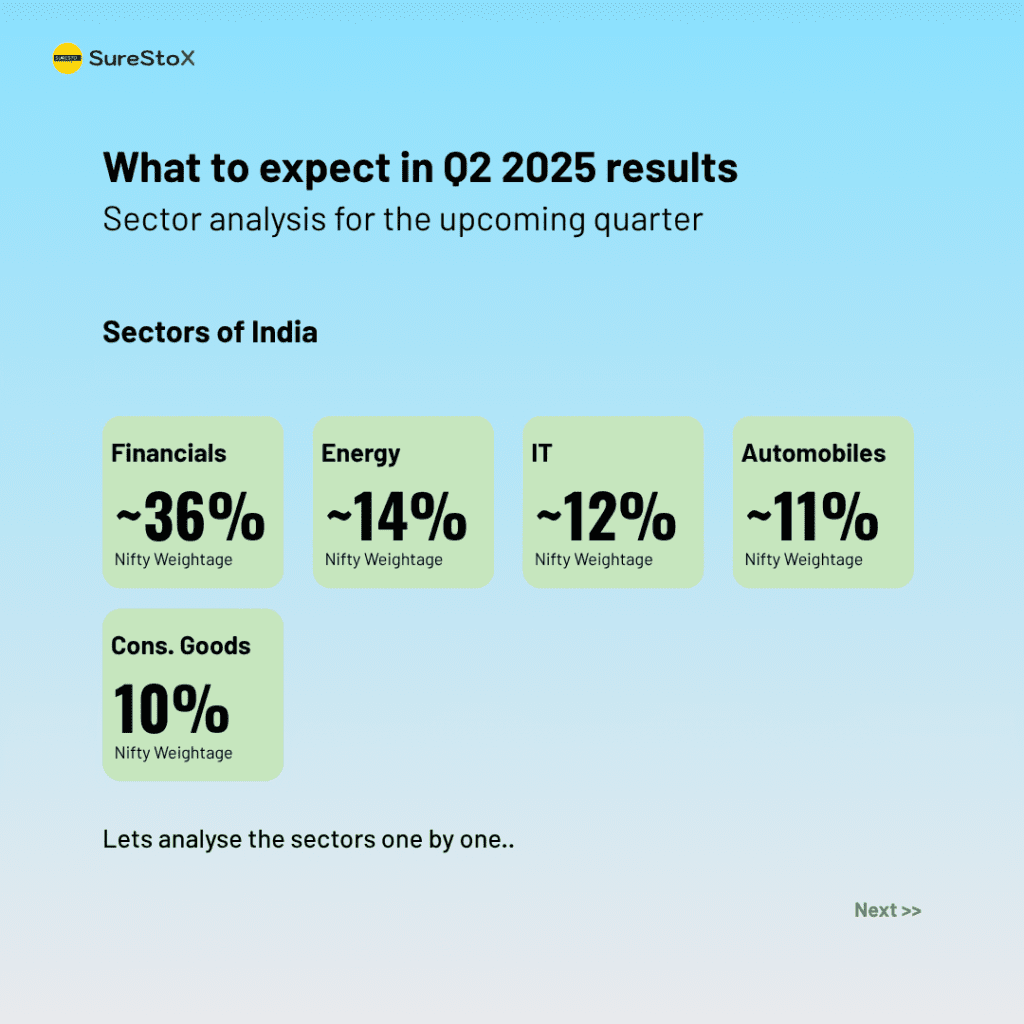

Sector Analysis

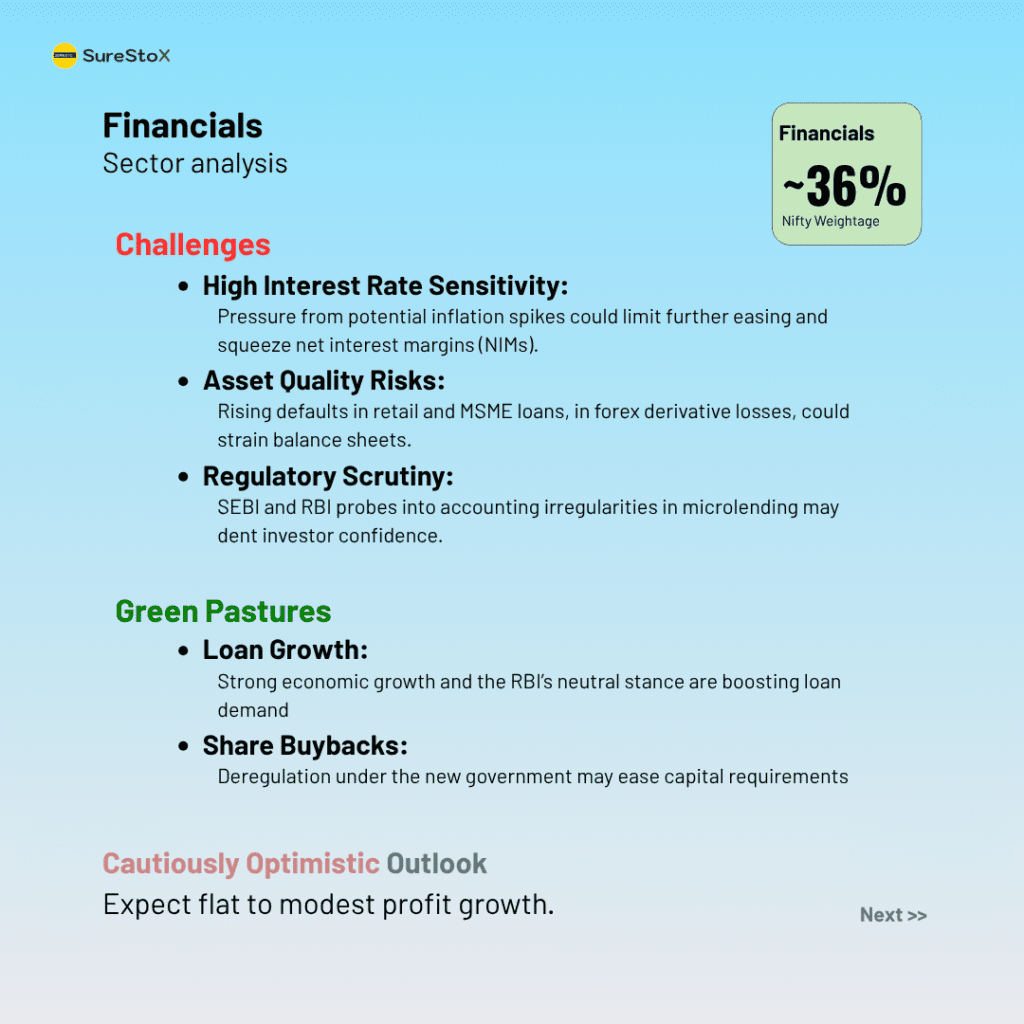

Financials: Leveraging Reduced Rates

Expertise-Driven Insight: The repo cut is poised to lift credit expansion to 14-15% in FY26, bolstering net interest margins, as per ICRA’s 6.2% GDP growth outlook.ibef.orgpib.gov.in

Opportunities: Banks such as HDFC and ICICI stand to gain 20-30 bps in NIMs from cheaper funding and robust retail lending.

Challenges: Bond portfolio pressures from global yields and oil volatility persist.

Moonshot Opportunities: Surge in digital lending could amplify gains if inflation stays low and consumption rises.

Outlook: Optimistic, forecasting 8-10% earnings rise with steady asset quality.

Consumer Goods: Capitalizing on Rural Uptick

Authoritative Context: Rural momentum fueled FMCG with 8.4% Q1 2025 volume growth, surpassing urban areas; CRISIL sees 7-9% FY25 revenue expansion extending into FY26.in.investing.com+2 more

Opportunities: Firms like Hindustan Unilever and Dabur could add 100-200 bps in revenue via rural focus and e-commerce.

Challenges: Brent at $70 may compress margins by 100-150 bps through higher input costs.

Moonshot Opportunities: Rural premiumization could yield outsized returns as incomes grow.

Outlook: Cautiously optimistic, anticipating 6-8% revenue growth tied to cost efficiencies.

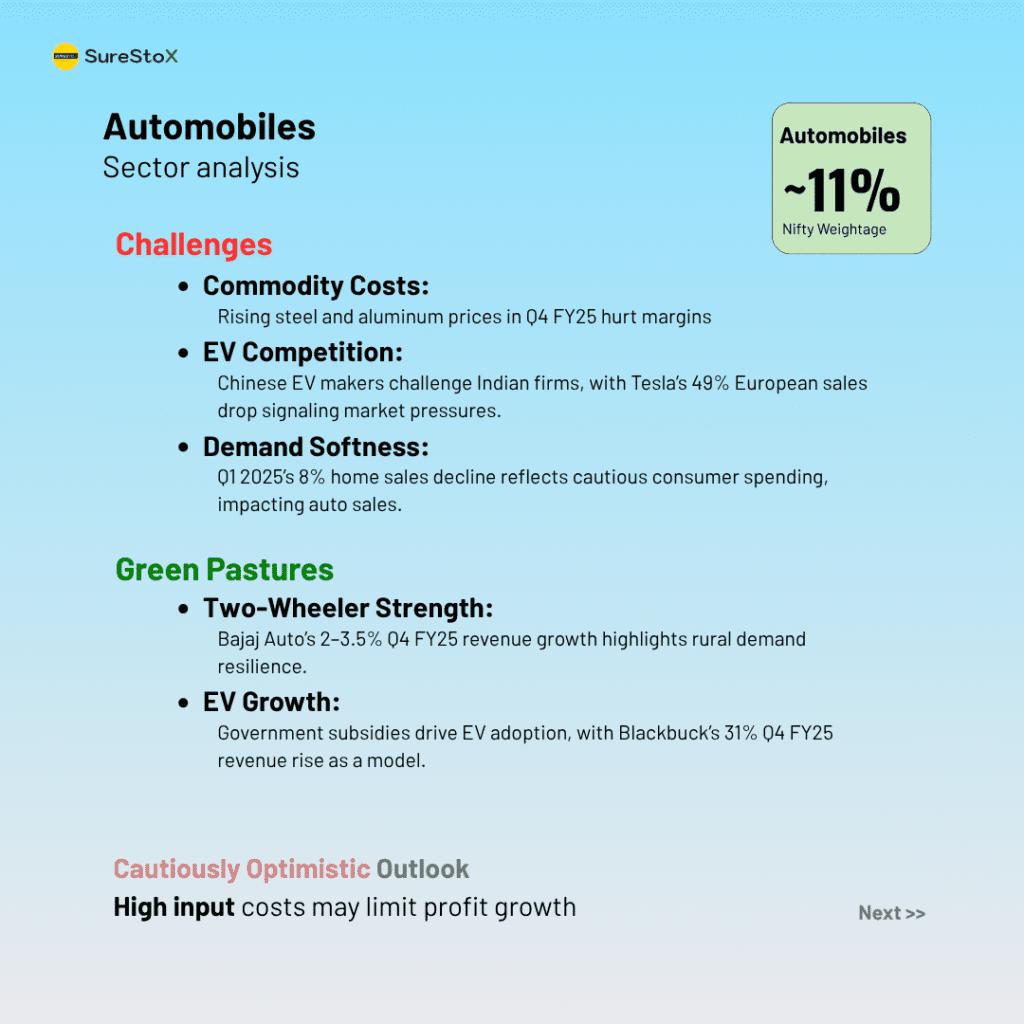

Automobiles: Building on Emerging Demand

Trustworthy Data: SIAM notes 2% FY24-25 passenger vehicle sales growth, with May 2025 up 0.8%, led by utility vehicles amid broader moderation.auto.economictimes.indiatimes.com+2 more

Opportunities: Festive boosts and lower finance rates may yield 10-12% volumes for Maruti Suzuki and Tata Motors, enhanced by EV incentives.

Challenges: Commodity hikes and supply disruptions could strain profitability.

Moonshot Opportunities: EV infrastructure acceleration might spark exceptional sector expansion.

Outlook: Optimistic, projecting 8-10% earnings in premium and electric categories.

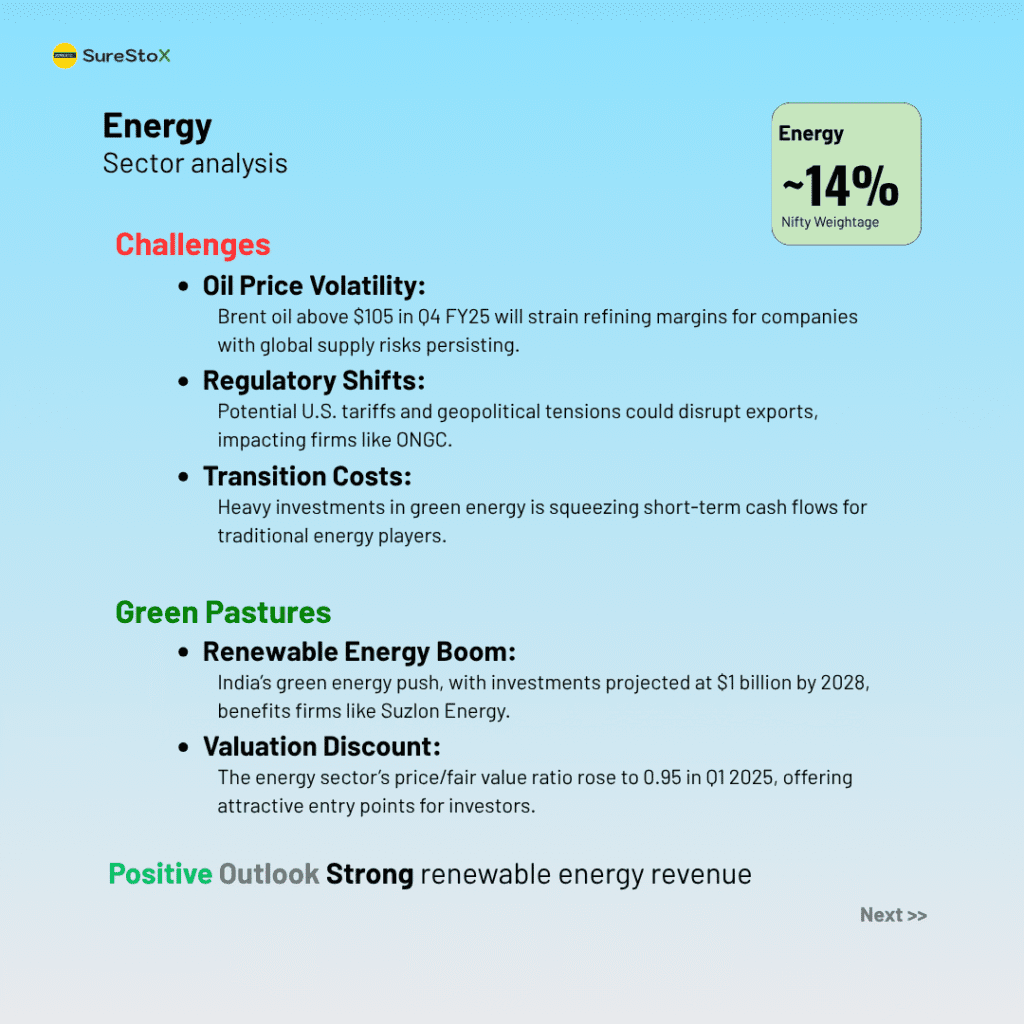

Energy: Progressing Through Renewables

Expertise-Driven Insight: Early 2025 saw 10 GW solar additions, supporting net-zero ambitions amid GDP projections.ibef.org

Opportunities: Adani Green and NTPC target clean energy gaps, backed by reliable coal for baseload.

Challenges: Oil at $70 raises expenses for conventional operators like ONGC.

Moonshot Opportunities: Electrification scale-up could propel rapid growth in renewables.

Outlook: Positive, expecting 10-12% revenue, dominated by green sources.

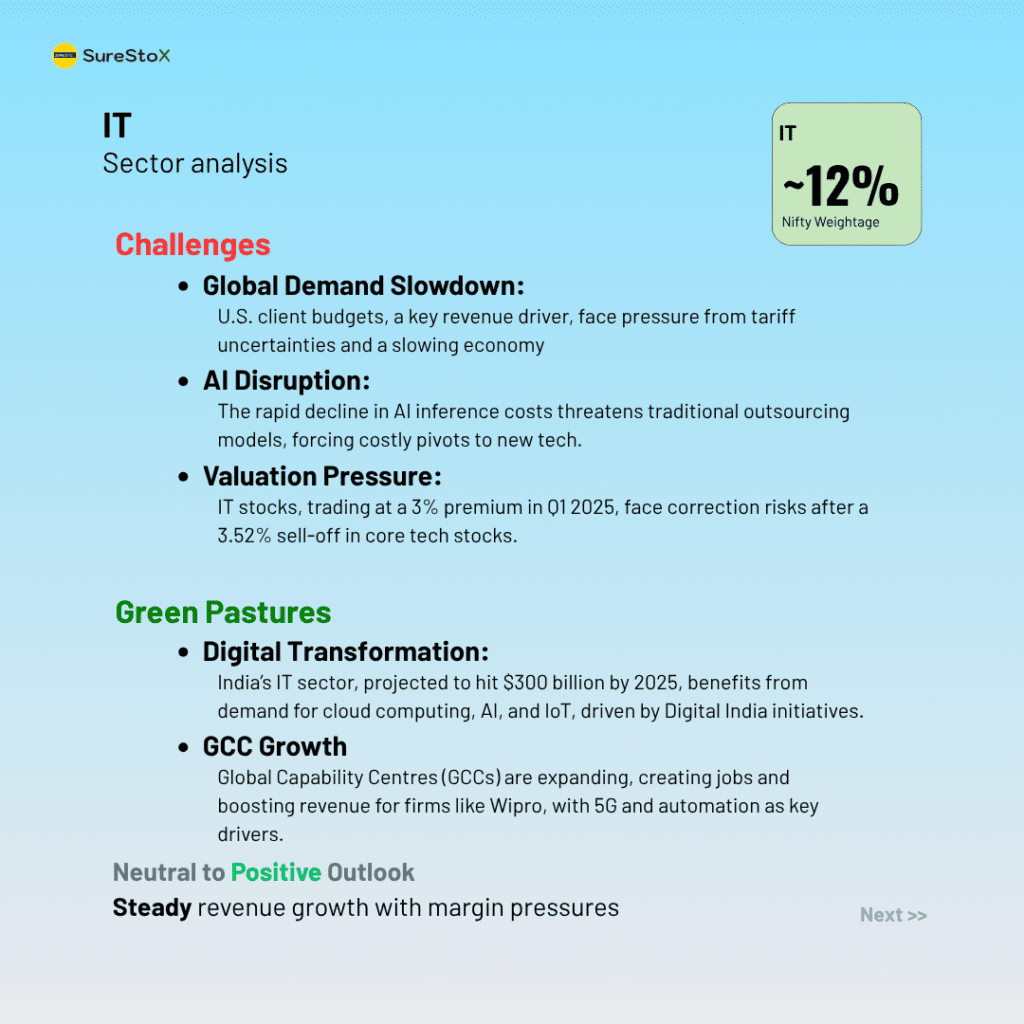

IT: Navigating Global Pressures

Authoritative Context: ICRA anticipates 2-3% FY26 revenue growth, with Gartner’s 11.2% India IT spend rise offset by U.S. constraints.ibef.org

Opportunities: Cloud and digital deals could maintain 7-8% for TCS and Infosys.

Challenges: Global risks and wage hikes may squeeze margins.

Moonshot Opportunities: AI adoption rebound could enhance profitability.

Outlook: Neutral, with low single-digit expansion.

Can Hope Outshine Fear?

Backed by June 2025’s 2.5% low inflation and consumption gains, RBI’s actions spark optimism for solid Q2 FY26 performance in Financials, Consumer Goods, and Automobiles.business-standard.com Still, market hesitation lingers from international threats and inflation uncertainties, challenging RBI’s projections.

Conclusion

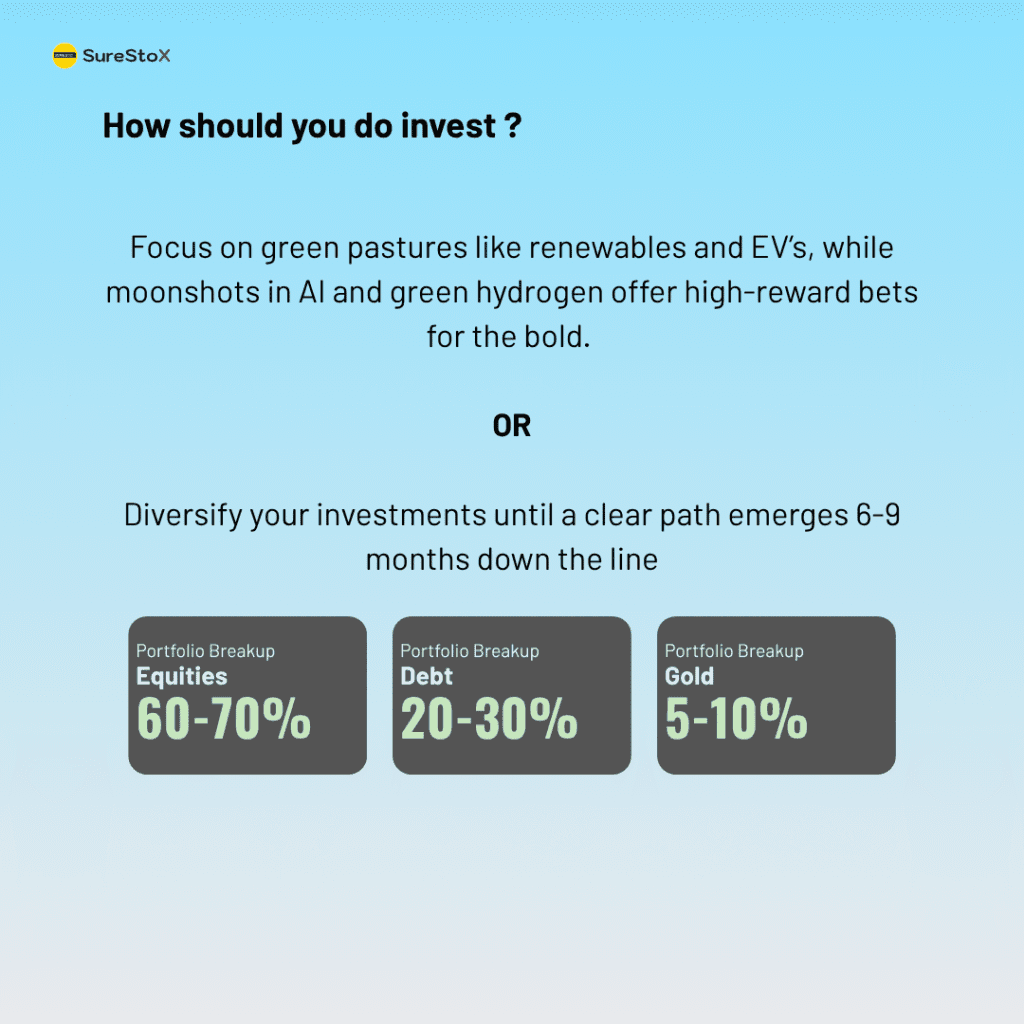

Despite RBI’s assertive measures, investor prudence prevails, reminiscent of measured responses in volatile times. Cuts favor Financials, Consumer Goods, and Automobiles; Energy advances on green energy, while IT navigates hurdles. Q2 FY26 projections: positive for Energy, optimistic for Financials and Automobiles, cautiously optimistic for Consumer Goods, neutral for IT. Sustained consumption and easing global tensions are vital for optimism to dominate; otherwise, restraint may linger.

Check out our earlier blog for valuable guidance on building a diversified investment portfolio to tackle this challenging situation.