Trend-Based Recommendations

Week 33

Surestox’s ~90% accurate trend identification pinpointed five high-probability trades with win ratios above 80%, delivering returns up to 7.6% in volatile markets. AsisViews’ news-decoding platform provided critical insights, empowering investors to navigate tariff concerns, FII outflows, and global growth fears. Here’s a concise breakdown of each stock’s performance and key drivers.

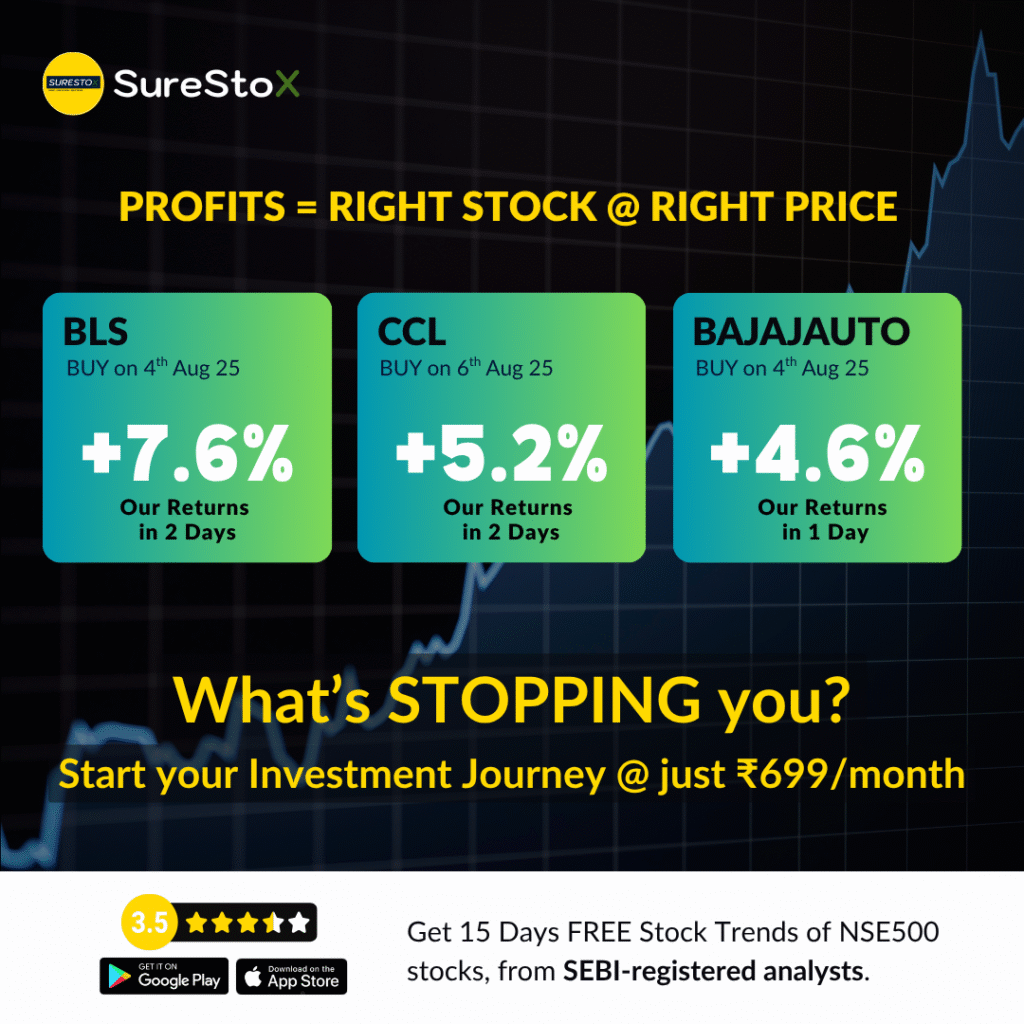

1. BLS International Services (BLS) | +7.6%Returns in 2 Days

BLS International Services, a leader in visa and consular services, delivered a 7.6% gain in 2 days following a buy signal on August 4. Surestox identified a breakout above ₹445, with the RSI above 60 and On-Balance Volume (OBV) signaling strong buying pressure. AsisViews highlighted BLS’s Q1 FY26 revenue growth of 28.51% YoY to ₹492.65 Cr and net profit up 69.62% to ₹120.8 Cr, driven by e-governance and visa processing demand. With a ₹19,934 Cr market cap and P/E of 48.91, BLS benefited from India’s 59.2 manufacturing PMI and digitalization trends. The stock surged from ₹445 to ₹479; traders could have set a stop-loss below ₹435.

2. CCL Products (India) Limited (CCL) | +5.2% Returns in 2 Days

CCL Products, a key player in FMCG (coffee exports), gained 5.2% in 2 days after a buy signal on August 6. Surestox’s analysis confirmed a breakout above ₹680, with a bullish MACD crossover and RRG showing leadership in the FMCG sector. AsisViews noted CCL’s 18.3% YoY revenue growth to ₹733.5 Cr in Q1 FY26 and a ₹9,514 Cr market cap. Despite a 52-week range of ₹559–₹768.95, CCL’s 4.4% dividend yield and export focus cushioned it against domestic market volatility. The stock rose from ₹680 to ₹715; a stop-loss below ₹670 was prudent.

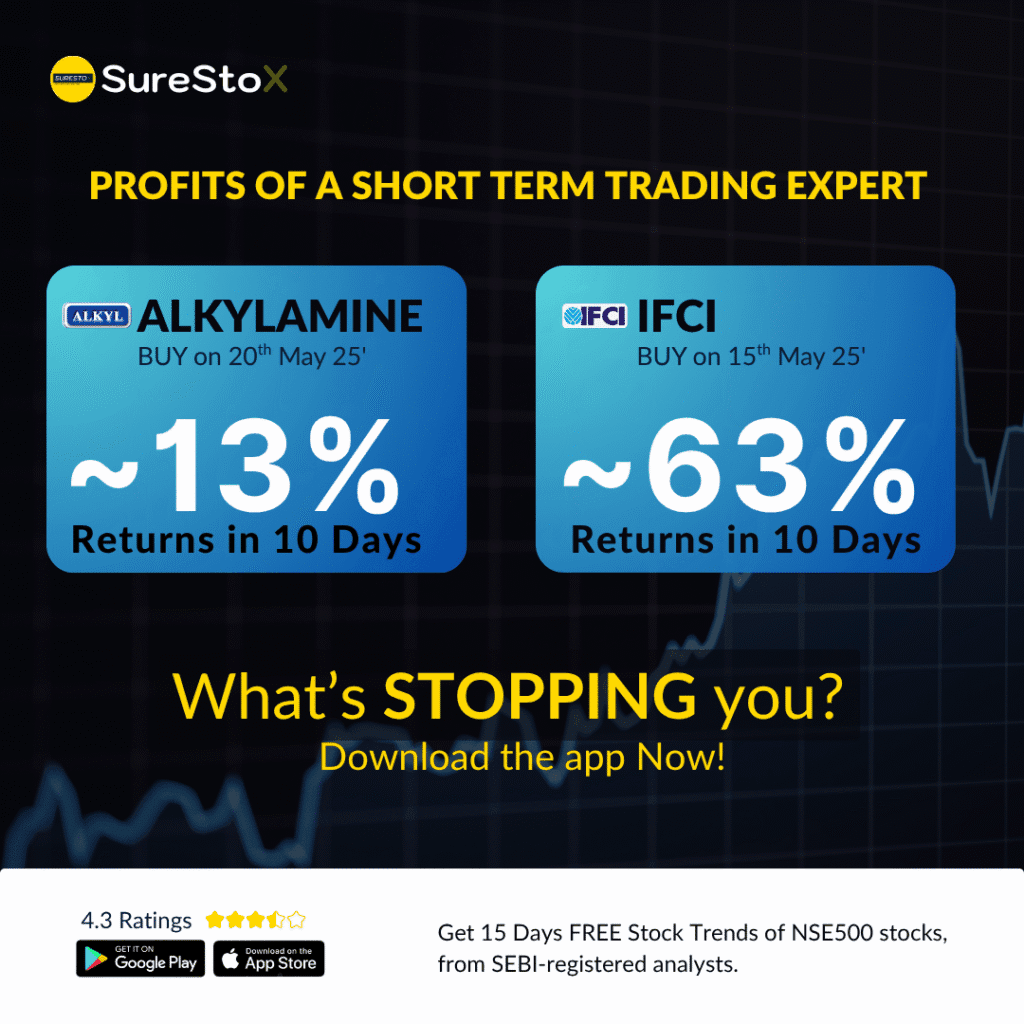

Surestox’s ~90% accurate trend analysis, paired with AsisViews’ news-decoding insights, delivered an average 10.5% return in Week 28. CUB (+12%), Aster DM (+10.5%), Blue Dart (+10.5%), Syrma (+9.8%), and Asahi India (+9.3%) capitalized on banking, healthcare, logistics, EMS, and auto sector tailwinds. Investors can monitor these trends with AsisViews for market clarity and Surestox for precision.

Get the App

3. Bajaj Auto Limited (BAJAJ-AUTO) | +4.6% Returns in 1 Day

Bajaj Auto, a leading auto manufacturer, achieved a 4.6% gain in 1 day after a buy signal on August 7. Surestox detected a breakout above ₹9,000, with OBV indicating accumulation and RSI in the leading quadrant. AsisViews reported a 15.96% YoY sales volume growth in Q1 FY26 and a ₹2,66,050.12 Cr market cap, with a P/E of 32.45. Web data notes a 52-week range of ₹7,000–₹10,308.45 and a ₹11,666.65 analyst target. The auto sector’s resilience amid tariff concerns supported the rally from ₹9,000 to ₹9,414; a stop-loss below ₹8,900 was recommended.

4. Hero MotoCorp Limited (HEROMOTOCO) | +4.4% Returns in 1 Day

Hero MotoCorp, another auto giant, returned 4.4% in 1 day following a buy signal on August 6. Surestox’s analysis showed a breakout above ₹4,815, with a bullish MACD and strong volume support. AsisViews highlighted a 15.83% YoY sales increase to 15.02 lakh units in Q1 FY26 and a ₹1,00,362.05 Cr market cap, with a P/E of 25.04. A 52-week range of ₹3,741.85–₹5,894.55 and a ₹6,033.45 analyst target reflect optimism. The stock climbed from ₹4,815 to ₹5,027; a stop-loss below ₹4,750 was advised.

5. MphasiS Limited (MPHASIS) | +4% Returns in 2 Days

MphasiS, an IT services leader, posted a 4% gain in 2 days after a buy signal on August 4. Surestox identified a breakout above ₹2,555, with RSI above 50 and OBV confirming buyer interest. AsisViews noted a 7.8% YoY revenue growth to ₹3,420.78 Cr in Q1 FY26 and a ₹50,112.85 Cr market cap, with a P/E of 31.51. Despite IT sector weakness on August 8, MphasiS’s cloud and digital transformation focus drove gains. The stock rose from ₹2,555 to ₹2,657; a stop-loss below ₹2,500 was suggested.