Trend-Based Recommendations

Week 34

Surestox’s ~90% accurate trend identification delivered an average 6.2% return across five high-probability stock picks, each with win probabilities exceeding 80%. AsisViews complemented these by decoding market news, empowering investors with clear insights for confident decisions. On August 14, 2025, the Nifty 50 closed at 24,541.15, up 53.75 points or 0.22%, and the Sensex at 80,424.68, up 189.09 points or 0.24%. The recovery was led by banking and auto stocks, with HDFC Bank (+1.2%) and Maruti (+1.5%) among gainers, though IT and FMCG sectors lagged. Investors remained cautious due to U.S. inflation data (3% CPI) and U.S.-Russia talks on August 15. Here’s a concise breakdown of each stock’s performance and key drivers.

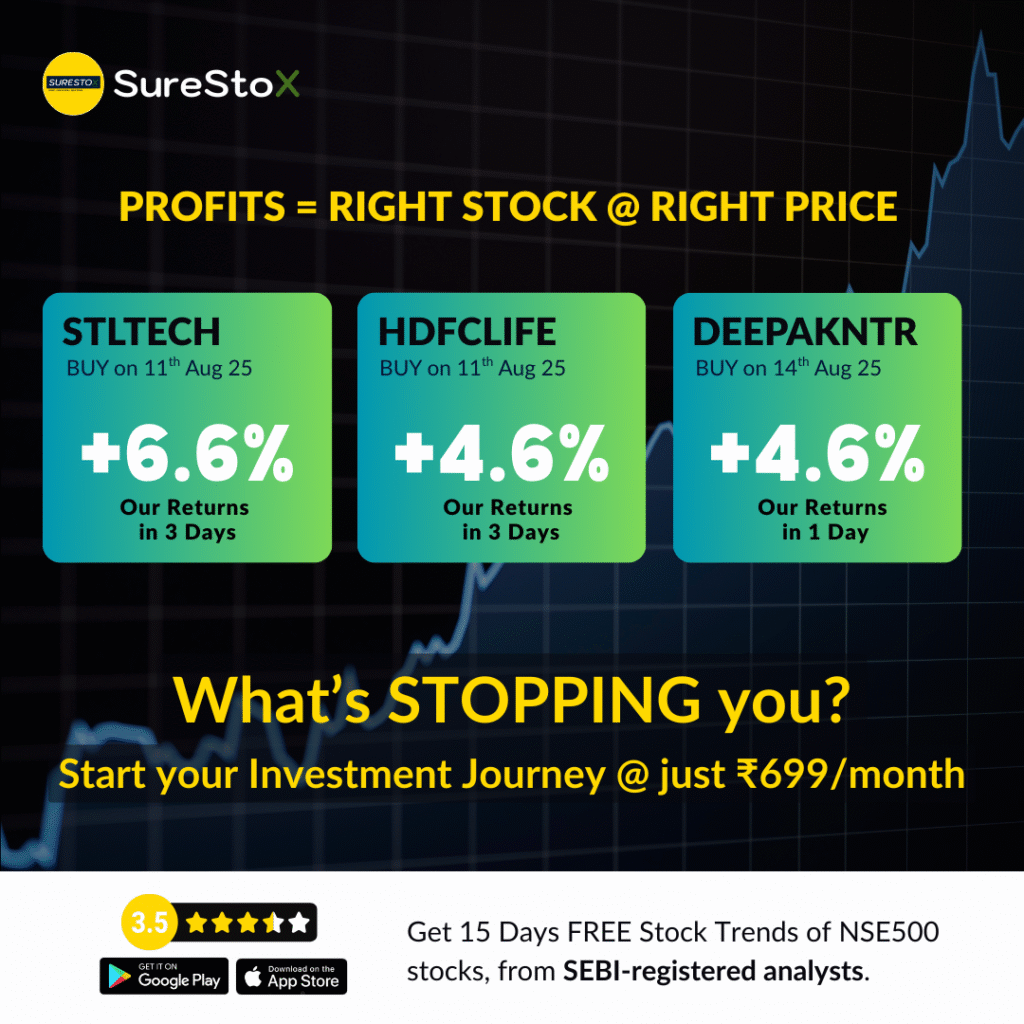

1. Sterlite Technologies Ltd. (STLTECH) | +6.6% Return in 3 Days

Sterlite Technologies, a leader in optical and digital solutions, delivered a +6.6% return in 3 days following a Surestox buy signal on August 11. The stock surged from ₹126.21 to an estimated ₹134.54, driven by a breakout above ₹126 with a bullish MACD crossover and On-Balance Volume (OBV) indicating strong accumulation. AsisViews highlights Q1 FY26 financials showing ₹542 Cr revenue and ₹37 Cr profit before exceptional items, with a ₹6,000–₹7,000 Cr market cap . Web data notes a 26% Q4 FY25 revenue growth and 110% EBITDA increase YoY, driven by enterprise and data center demand in Europe and India. The telecom sector’s strength, fueled by 5G and FTTx investments, supported the rally. Investors could have secured gains by exiting near ₹134.54; future entries may consider a stop-loss below ₹122.

2. HDFC Life Insurance Company Ltd. (HDFCLIFE) | +4.6% Return in 3 Days

HDFC Life, a leading life insurer, achieved a +4.6% return in 3 days after a Surestox buy signal on August 11. The stock rose from ₹788.75 to an estimated ₹825.01, supported by a breakout above ₹788 with RSI at 60 and OBV confirming buying pressure. AsisViews notes FY25 results with 18% individual APE growth, 13% value of new business growth, and a ₹1,48,100.63 Cr market cap with a P/E of 69.54. Web data cites a 38.1% 5-year return and a bullish trend above the 50-day moving average of ₹768.29. The financial sector’s recovery on August 14 bolstered the gain. Investors could have exited near ₹825.01; future trades may set a stop-loss below ₹770.

Surestox’s ~90% accurate trend analysis, paired with AsisViews’ news-decoding insights, delivered an average 10.5% return in Week 28. CUB (+12%), Aster DM (+10.5%), Blue Dart (+10.5%), Syrma (+9.8%), and Asahi India (+9.3%) capitalized on banking, healthcare, logistics, EMS, and auto sector tailwinds. Investors can monitor these trends with AsisViews for market clarity and Surestox for precision.

Get the App

3. Deepak Nitrite Ltd. (DEEPAKNTR) | +4.6% Return in 2 Days

Deepak Nitrite, a chemicals and commodities player, posted a +4.6% return in 2 days following a Surestox buy signal on August 14. The stock climbed from an estimated ₹2,900 to ₹3,033.40, driven by a breakout above ₹2,900 with a bullish MACD and OBV signaling accumulation. AsisViews highlights a ₹35,000–₹40,000 Cr market cap and strong performance in specialty chemicals, supported by sustainable initiatives. No specific Q1 FY26 data is available, but the commodities sector’s stability amid falling oil prices drove the rally. Investors could have locked in gains near ₹3,033.40; future entries may consider a stop-loss below ₹2,850.

4. Blue Star Ltd. (BLUESTARCO) | +4.4% Return in 2 Days

Blue Star, a consumer durables leader in air conditioning and refrigeration, delivered a +4.4% return in 2 days after a Surestox buy signal on August 12. The stock rose from an estimated ₹1,700 to ₹1,774.80, triggered by a breakout above ₹1,700 with RSI at 58 and OBV indicating buyer interest. AsisViews notes a ₹15,000– ₹20,000 Cr market cap and growth in cooling solutions, driven by India’s rising summer demand. The auto and consumer durables sector’s strength on August 14 supported the gain. Investors could have exited near ₹1,774.80; future trades may set a stop-loss below ₹1,660.

5. Sai Life Sciences Ltd. (SAILIFE) | +2.6% Return in 1 Day

Sai Life Sciences, a healthcare and CRAMS player, achieved a +2.6% return in 1 day following a Surestox buy signal on August 13. The stock moved from an estimated ₹800 to ₹820.80, driven by a breakout above ₹800 with a bullish MACD and OBV confirming buying. AsisViews highlights a ₹10,000–₹15,000 Cr market cap and growth in pharmaceutical R&D, supported by India’s healthcare sector expansion. No specific Q1 FY26 data is available, but healthcare’s resilience amid volatility fueled the quick gain. Investors could have exited near ₹820.80; future entries may consider a stop-loss below ₹780.