Daily Nifty Moves Report

By surestox.co.in & asisview.com | Aug 08, 2025

Broader Market Sentiment

The Indian stock market exhibited a bearish bias today, closing on a weak note amid heightened global trade tensions. US tariffs on Indian exports, including a 25% levy on certain goods and potential escalations to 100% on semiconductors, weighed heavily on investor confidence. Continuous FII outflows and volatility in key sectors like metals and realty further dampened sentiment. However, domestic institutional buying provided some cushion, preventing deeper losses. Broader indices like midcaps and smallcaps underperformed, reflecting caution among retail investors. Global cues were mixed, with Asian markets showing slight gains but US indices ending flat to negative. Overall, the market appears vulnerable to further downside if trade uncertainties persist, though selective buying in defensives like utilities hinted at resilience.

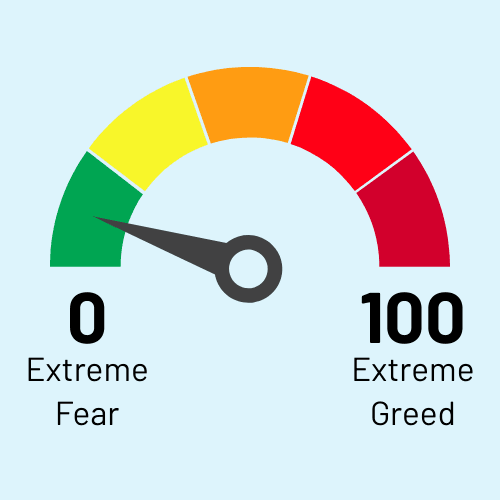

India’s Fear & Greed Index: (Aug 3 – Aug 8, 2025)

The India-MM Fear and Greed Index dipped to 25.45, signaling extreme fear driven by external pressures like US tariffs and geopolitical risks. This low reading indicates oversold conditions, where panic selling dominates, but it could also prelude a rebound if positive triggers emerge. High volatility, as reflected in elevated India VIX levels, underscores investor anxiety. Commentary: In such fear-dominated phases, long-term investors may find value-buying opportunities, but short-term traders should exercise caution, focusing on risk management amid potential mean reversion.

Market Data

Index Movement

| Metric | Value |

|---|---|

| Open | 24,550 |

| High | 24,650 |

| Low | 24,350 |

| Close | 24,363 |

| Change | -0.95% |

Top 5 World Exchanges

| Index/Exchange | Close | Change(%) |

|---|---|---|

| Dow Jones | 43,989.6 | -0.51% |

| Nasdaq | 21,501 | +0.37% |

| FTSE 100 | 7,725 | +0.21% |

| Nikkei 225 | 41,820.5 | +1.85% |

| Hang Seng | 24,858.5 | -0.89% |

FII and DII data

| Net Equity (₹ Cr) | Net Debt (₹ Cr) | Total (₹ Cr) | |

|---|---|---|---|

| FII | ₹ -4999 | ₹ 0 | ₹ -4999 |

| DII | ₹ 6794 | ₹ 0 | ₹ 6794 |

Foreign Institutional Investors continued their selling spree, offloading equities worth nearly ₹5,000 Cr, marking the sixth consecutive session of outflows. This was largely attributed to US tariff threats eroding confidence in export-oriented sectors. Cumulative FII selling in August stands at over ₹78,000 Cr, pressuring the rupee and broader indices. In contrast, Domestic Institutional Investors stepped up as net buyers, injecting over ₹6,700 Cr to stabilize the market. Commentary: The stark divergence highlights DIIs’ role as a counterbalance, driven by strong domestic liquidity and optimism around India’s long-term growth story. However, sustained FII exits could prolong the downturn unless global sentiment improves.

Heat Map of the 7 Core Sectors

Financial Services

-1.2%

Consumer Goods

-0.4%

Oil and Gas

-0.8%

IT

-0.7%

Healthcare

-0.6%

Automobile

-1.5%

Metals

-2.1%

Tomorrow’s Watch Outs

Key events to watch on August 09, 2025:

- Earnings Releases: Key Q1 results from companies like SBI, Hero MotoCorp extensions, and midcaps in infra and consumer sectors; watch for guidance amid tariff impacts.

- Economic Data: Potential release of industrial production figures; any softness could heighten volatility.

- Trade Developments: Ongoing US-India trade talks; delegation visit on Aug 25 may influence sentiment. Monitor updates on India-UK FTA implementation, signed in July 2025, which could boost exports in textiles and services.

- Geopolitical Cues: PM Modi’s potential China visit end-August; any positive signals on border or trade could lift mood.

- Market Triggers: Weekly close critical; Nifty below 24,300 risks further slide. Global oil prices and rupee movement key, with USD/INR near 84.

- Other Events: No major RBI announcements, but forex reserves data may provide clues on intervention. Watch FII flows for continuation of selling pressure.